Objective

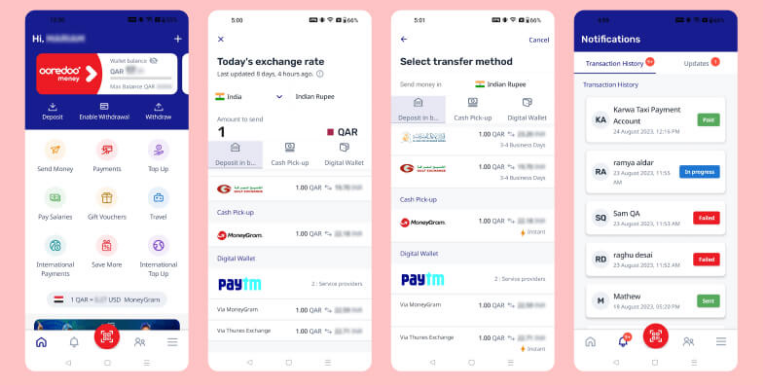

Implementing a Customer Data Platform (CDP) in a fintech or digital wallet app like Ooredoo Money transforms personalization, engagement, and monetization strategies with data-driven precision.

Unified Customer View Across Channels

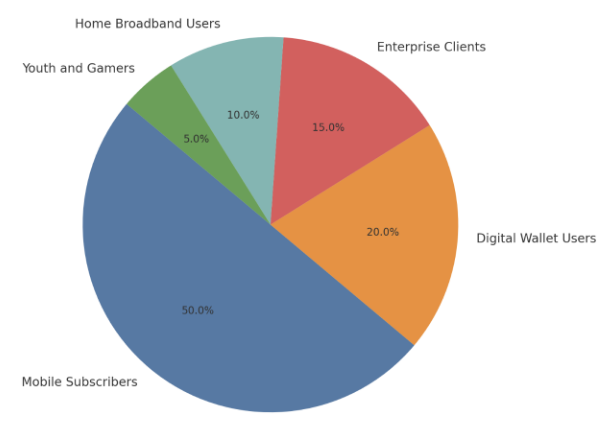

Integrated data from various sources including app, website, call center, USSD, SMS, and POS to create a unified customer profile. Mapped behaviors such as top-ups, transfers, bill payments, and remittances alongside demographic and transactional data to segment customers effectively. Identified key customer.

This approach provided a 360° view of customer distribution, enabling precise targeting and engagement strategies tailored to each segment.

Real-Time Journey Orchestration

Streamlined user onboarding with automated workflows, such as sending reminders to add payment methods or complete KYC processes. Implemented behavior-reactive actions, like tutorials for users abandoning transactions, to enhance engagement and improve user satisfaction.

Advanced Analytics & Segmentation

Utilized predictive analytics and cohort analysis to identify key user segments, including power users and churn risks, and evaluate retention after campaigns or feature launches. Uncovered insights into features driving long-term user engagement, such as bill payments or P2P transfers.

Monetization & Cross-Sell

Promoted high-margin financial products like micro-loans, insurance, and international transfers to relevant users based on their activity. Conducted experiments on pricing models, service fees, and reward thresholds to optimize monetization strategies and increase revenue.

Compliance & Data Governance

Ensured compliance with PDPPL regulations by implementing consent tracking and centralized data governance systems. Maintained robust privacy protocols to safeguard sensitive financial and personally identifiable information (PII).

Integration with MarTech & FinTech Stack

Seamlessly integrated the CDP with CRM platforms, SMS gateways, email systems, ad networks, and analytics tools like GA4 and Mixpanel. Enhanced fraud detection by sharing behavioral signals with security systems, further securing customer data and operations.

Tools Used

The selection of tools were carefully aligned with the app’s strategic goals, focusing on personalization, engagement, and scalability.